About The Option Profiteer

The Option Profiteer System is a conservative method of selling Covered Call Options in your tax-deferred retirement account, such as an IRA, to grow your retirement nest egg.

Investing in the stock and options markets can be risky business. Markets rise and fall precipitously, scaring investors out of the market at the worst time ... when their account values are at rock bottom. Selling covered call options can lower the risk of owning stock.

Owning high quality stocks and writing covered call options against your shares is one way to ride out the ups and downs of the market and add to your account value.

Think of covered call options as a lease-option that you write on your shares. It's like renting those shares to someone else and giving them an option to buy them from you. For that privilege, you earn cash payments from those other investors.

The best part is that you write the contract to your terms and specifications, including the price and expiration date. When the expiration date comes, the other person will either buy you out at your pre-set price, or walk away from the opportunity. It's all about control.

Either way, you keep the cash payment that was paid to you up front. And if they buy your shares at the contract price that you set, you also make a profit on the sale. Then, repeat the process again and again. The manual guides you through it.

We conduct these transactions in our self-directed tax-deferred IRA and recommend that you do the same. Always talk to your accountant first.

The Option Profiteer System has been around since 1999 and is completely affordable for anyone at just $17. Buy it, use it, and prepare for a more abundant retirement lifestyle.

How It Works

The Option Profiteer manual begins with a 1-page Quick-Start guide. If you're already investment-savvy and have opened an online investing account, this might be all you need.

When you read the manual, you'll find that it's explained in layman terms. It takes you chronologically through several different transactions.

Each covered call transaction is associated with 100 shares of stock. If you own 200 shares of a particular stock, you can sell (or write, in official jargon) two covered call contracts. We typically buy shares in lots of 500 or 1000 so we can write 5 or 10 contracts at once.

When you write your contract, which is automated and easy-to-understand, you receive cash from the person who buys it. That obligates you to sell your shares to that person if they ask for them before the contract expires. All of this is done in the background and you deal with your online broker, not another individual.

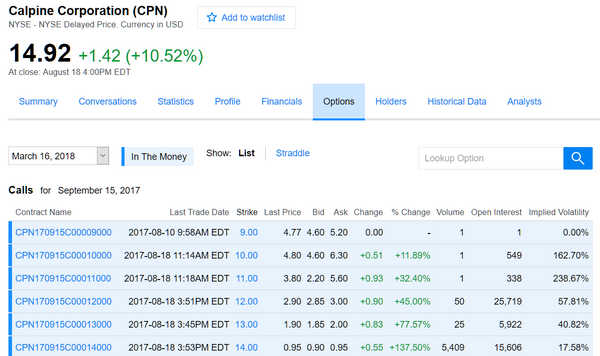

Note: Any images displaying prices on this page are not current prices.

If the buyer demands your shares, you make money twice; once when you sell the contract (the payment you receive is called the premium) and once again when you sell the shares (the payment you receive is called the income).

The beautiful part of writing a covered call contract is that you decide how much you get paid and when you get it. The process is all under your control.

You will set a time limit for when the contract expires. If your buyer does not demand your shares by that expiration date, you keep your shares and you keep the premium he paid you for his option to buy your shares. Then you can start the process all over again.

If you have any real estate experience, this will click instantly (except that it's a lot easier than real estate). Think of this same transaction with a house, instead of shares in a company. Those of you who are unsure of yourselves will work through practice transactions until it sinks in. Really, it's a simple process so don't try to complicate it. You just have to learn the details, which are all explained very clearly.

What Do I Get?

If you're thinking of retirement income, The Option Profiteer can help. Here's what you get:

- Our MANUAL is more than 50 pages printed in large easy-to-read type and contains useful example transactions to help you learn.

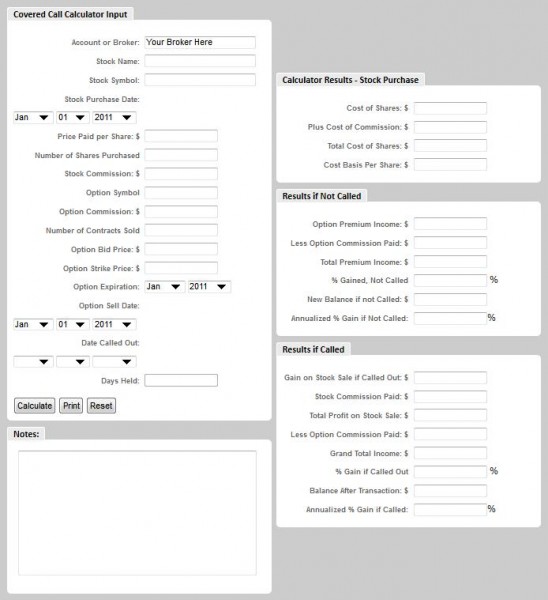

- The COVERED CALL CALCULATOR shows you how much money you can make on your transactions before you actually trade.

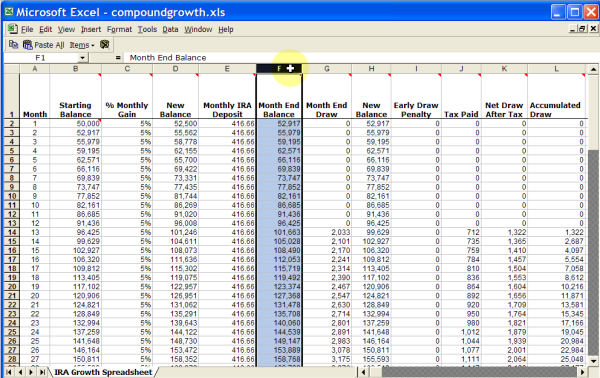

- Our MAGIC OF COMPOUNDING spreadsheet shows you how compound interest can multiply your original investment dramatically over time.

- A 14 MINUTE VIDEO walks you through the use of the compounding spreadsheet.

- The Option Profiteer System comes with a 100% money-back guarantee of your purchase price. If you're not happy, we're not happy. Simple.

Why Should I Use The Option Profiteer System?

Simply put, you can earn profits on your stock investments at your own schedule and in a safe and conservative manner.

By learning the techniques found in The Option Profiteer, you will gain an advantage that buy-and-hold investors can only dream of.

Being a self-directed investor can put you in control of your retirement funds, giving you an advantage others don't have.

What are you waiting for? If you're not happy, you get your money back.

Just click on the PayPal button below for secure service.

Disclaimer:

In accordance with government regulations, our website does not make financial recommendations or predict markets. As with any type of investing, you could lose money by selling covered call options. Do your homework, speak with your financial advisor, and proceed with caution. The Option Profiteer System is offered as an educational tool to help you learn about covered call options.